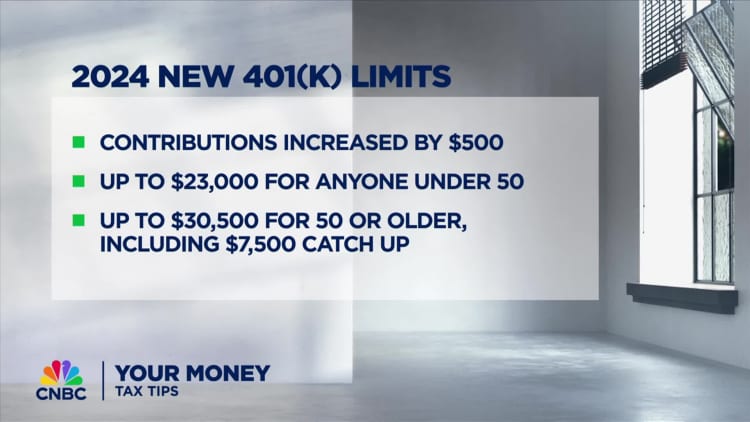

Last Day To Contribute To 401k 2024 Catch – In 2024, the 401(k) contribution limits have gone up. While last year you could contribute a maximum of $22,500 (plus an additional $7,500 catch-up contribution for those 50 or over), the 2024 . If you’re 50 or older, you may be eligible to contribute an extra $7,500 to your 401(k) in 2024 to last and what you think your lifestyle will be like. But it’s clear that catch-up .

Last Day To Contribute To 401k 2024 Catch

Source : www.cnbc.com401k Contribution Limits For 2023

Source : thecollegeinvestor.comThe 401(k) Catch Up Contributions Problem for 2024 | Kiplinger

Source : www.kiplinger.com2024 Tax Tips: New 401(k) limits

Source : www.cnbc.comSelf Directed Roth Solo 401k Contribution Limits for 2024 My

Source : www.mysolo401k.netSECURE 2.0: Big changes to 401(k) catch up contributions in 2024

Source : www.benefitspro.com2024 Contribution Limits Announced by the IRS

Source : www.advantaira.com2024 Challenge of 401(k) Catch Up Contributions ICG Next

Source : icgnext.com2024 Challenge of 401(k) Catch Up Contributions Bridge Quest

Source : bridgequest.com401(k) Contribution Limits in 2024 Meld Financial

Source : meldfinancial.comLast Day To Contribute To 401k 2024 Catch 2024 Tax Tips: New 401(k) limits: The income thresholds to be eligible for a Roth IRA are also higher in 2024. For single and head-of-household taxpayers, the income phase-out range is between $146,000 and $161,000, up from between . Limits are still increasing in 2024, just not as significantly. Here are the 401(k) contribution limits for 2023 and 2024: Taxpayers age 50 and older can make what the IRS calls “catch-up .

]]>